property tax assistance program ohio

Up 16 over last year continuing hot market. Funded by the Ohio Housing Finance Agency OHFA via US.

Average Tax Refund Climbs To 3 034 So Far This Year Tax Refund Income Tax Return Income Tax

Learn about available energy assistance programsCall 866 243-5678 to be connected to the area agency on aging serving your community to see if.

. The Property Tax Assistance Program PTAP is a group that assists qualifying seniors or those with a permanent disability with onetime financial assistance of partial or full payment of current homeowner taxes. To be eligibleyou must have a temporary or emergency need for assistance and not a chronic inability to pay. Ohio Home Energy Assistance Program HEAP A program that is funded by the federal government but run locally across OH.

The property tax assistance program is a process thats been in place since 1987 and a lot of property owners are not aware of it. Department of the Treasury these funds are made available through the American Rescue Plan of 2021. Our housing and financial counselors will work with you on all your financial needsfrom completing your tax return to reducing your debt improving your credit or saving for a big purchase.

What is the Property Tax Assistance Program. Welcome to the Ohio Tax Assistance Website We have funds and options available for delinquent taxes on a first come first served basis and assistance can only be given to one property per Ohio homeowner. Property Tax Assistance Program available in Franklin County for those who qualify Ohio Senate passes bill to change the process for challenging local property tax assessments November home prices in Franklin Co.

11152021 - Stinziano holds 150th Community Hours as Auditor. Payment of property taxes plus utilities home insurance and HOA fees. The exemption which takes the form of a credit on property tax bills allows qualifying homeowners to exempt up to 25000 of the market value of their homes from all local property taxes.

. Ad Register and Subscribe Now to work on OH Application for Financial Assistance Form. Assessors calculate the property value at 35 of the appraised value but the rate can vary.

The Property Tax Assistance Program combined with the proposed enhanced Homestead Exemption will help ensure that our older neighbors can remain integral parts of our community and can enjoy life. COLUMBUS Ohio Franklin County Auditor Michael Stinziano on Tuesday reminded older homeowners who need help paying their property taxes that the deadline to apply for the Property Tax Assistance Program PTAP is December 20. For example through the homestead exemption a home with a market value of 100000 is billed as if it is worth 75000.

State Capital Improvement Program Local Transportation Improvement Program SCIP LTIP Township 20 Funds. Some programs allow the creation of property tax installment plans for property owner s who are delinquent in paying taxes as a result of saying being unemployed for the last several months. 11162021 - Franklin County Fiscal Watchdog Launches New Property Protection Tool.

Get Funding For Rent Utilities Housing Education Disability and More. Contact the property tax department of your county or the largest local government to ask about hardship programs for property taxes. 6 rows Senior Citizens Property Tax AssistanceSenior Freeze.

The program helps qualifying lower-income homeowners age 60 and over with one-time emergency assistance in paying their property tax. This lifeline funded by the US. Any negotiated program will be effective after the local government officials have thoroughly reviewed the owners ability to pay and the request from.

Well Search Thousands Of Professionals To Find the One For Your Desired Need. And it allows for a one-time distribution for qualifying property. Some counties offer these.

This assistance program was designed to help eligible low-income Ohioans with paying the high costs of home heating or cooling bills. Ad Compare Tax Preparation Prices and Choose the Right Local Tax Accountants For Your Job. Eligible households can receive a one time payment of up to 10000.

11182021 - Property Tax Assistance Program Now Accepting Applications. A property tax freeze for seniors. Department of Treasurys Homeownership Assistance Fund is for Cuyahoga County homeowners who are facing financial hardships due to COVID-19 and need help paying property taxes.

To see if you qualify give us a call today at 614 333-0043 or fill out the form below to have one of our representatives give you a call. 11232021 - Auditors Office Refunding 5 Million to Franklin County Schools Libraries Municipalities. Documentation can also be.

Look Into a Hardship Program. Services are free of charge so call today at 216-881-8443. Ad Get Assistance for Rent Utilities Education Housing and More.

CHNs Property Tax Assistance Program is designed to prevent displacement and foreclosure of homeowners when that default is due to an inability to pay property taxes due toa pandemic-related hardship.

10 Things You Need To Know To Prepare You For Tax Season Financial Juneteenth Income Tax Preparation Tax Preparation Filing Taxes

Revise Income Tax Return Taxraahi Tax Saving Investment Income Tax Return Tax Payment

Find Tax Help Cuyahoga County Department Of Consumer Affairs

Get Up To 7k Towards Down Payment Assistance Home Buying Tips Single Level Floor Plans Home Buying Process

What Is An Employee Assistance Program How And Why To Create One

Top 4 Renovations For The Greatest Return On Investment Infographic Investing Infographic Renovations

Chart Current Mortgage Closing Costs Listed By State Closing Costs Mortgage Interest Mortgage

Down Payment Closing Cost Assistance Wvhdf

Employee Assistance Programs Eap Employee Assistance Programs Occupational Health Health Services

Property Tax Relief For Income Qualified Homeowners Local Housing Solutions

Ohio S Homeowner Assistance Plan

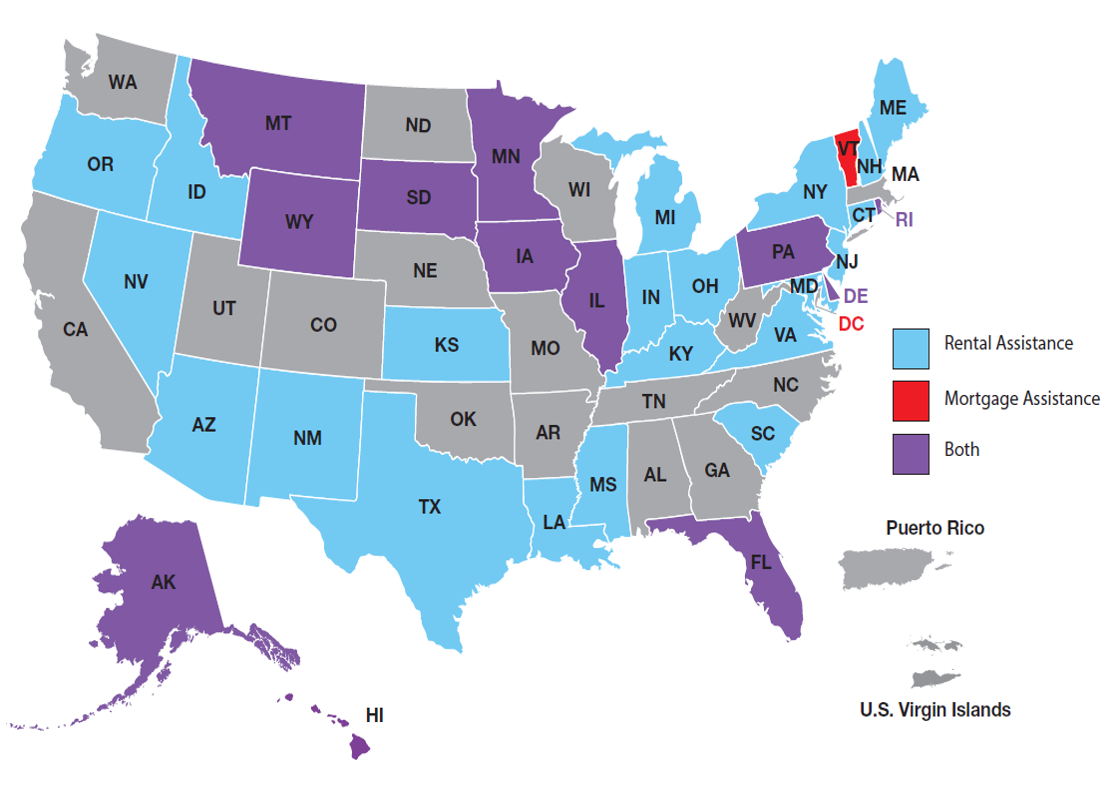

State Hfa Emergency Housing Assistance 2020 Programs Ncsha

What Is An Employee Assistance Program How And Why To Create One

Poster Tax Sign 24x18in In 2022 Tax Lawyer Signs Tax

Some Self Employed Taxpayers Get A Big Break Under New Law Financial Management Sales Jobs Financial Services

Pin By Marty Snyder Realtor On All Things Real Estate Mortgage Loans Mortgage Loan Officer Port Authority